There have been a number of media articles of late (like this one) about sham contractors and various test cases against disruptive businesses whose business models are often based on engaging gig workers.

The recent cases against Uber, Foodora and Deliveroo are just a few that have been watched closely, as the court’s findings in each is sure to have far reaching implications. And while you may not specifically engage gig workers, these cases are a good reminder for the need to understand what the courts look for when determining whether an employment relationship or independent contracting relationship exists.

What is a ‘Sham Contracting’ arrangement?

As it suggests, the term is given to an arrangement where the employer attempts to disguise what is really an employer/employee relationship as an independent contractor relationship to avoid the costs and legal responsibilities required of an employment relationship such as minimum wages, penalty rates, superannuation, workers’ compensation and certain taxes.

What makes an individual a contractor and not another employee?

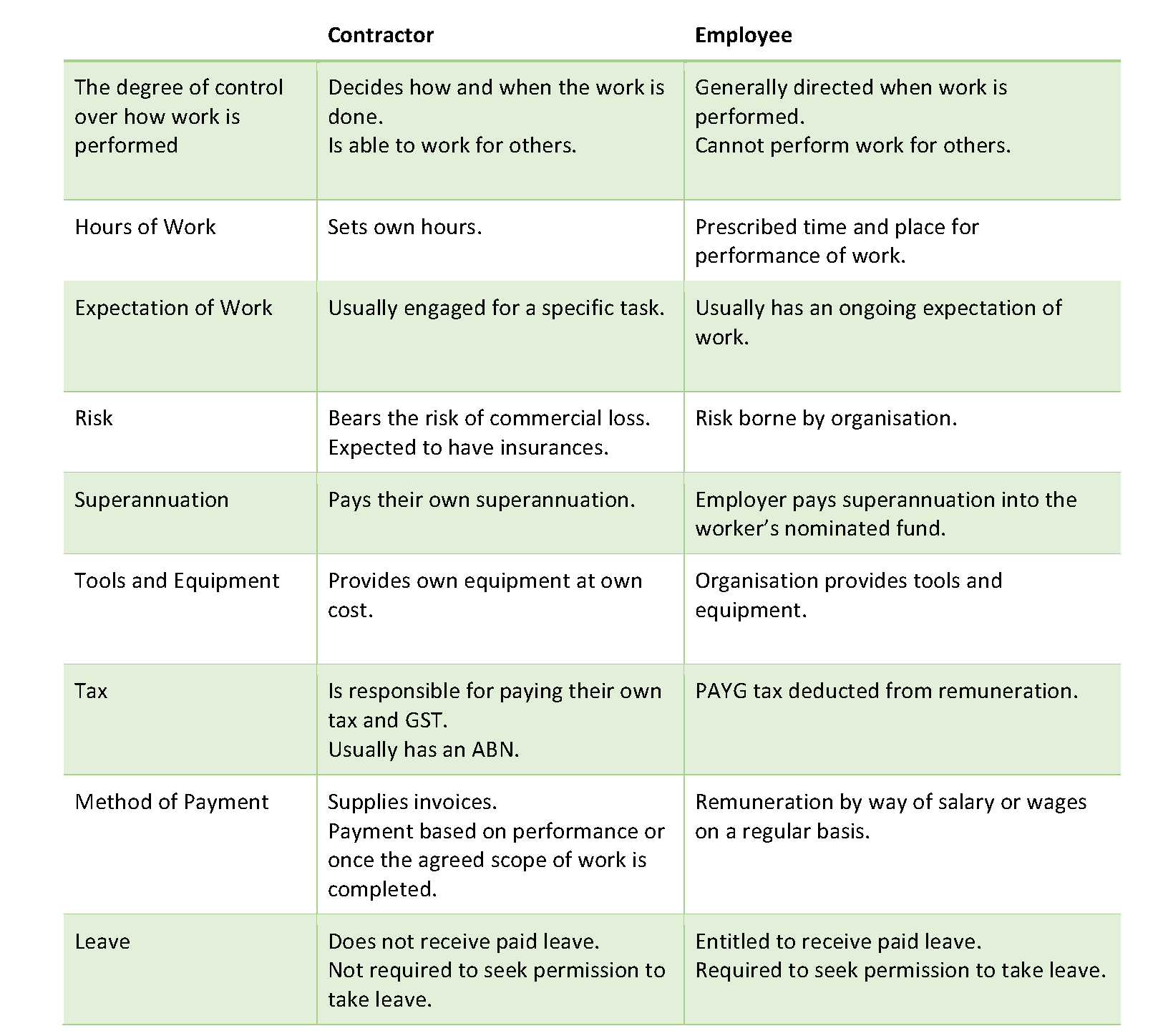

The answer to this question isn’t always clear cut. However, there are a number of guiding principles that the courts consider when deciding if an independent contractor or employment relationship exists. What this means is that a business can’t simply call

someone a contractor and pay them as a contractor. If tested, the courts will look to the ‘real substance’ of the relationship in question and the degree of control the business has over the worker. The more control the business has over the worker, the more likely the worker would be considered to be an employee.

These are some common indicators that would be assessed and what these factors usually look like for a contractor versus an employee.

Other Considerations

In addition to the legal pay and leave entitlements required for employees (minimum wages, superannuation, workers’ compensation and leave), whether an individual is an independent contractor or employee also impacts their ability to access a claim of Unfair Dismissal. A true independent contractor, one who provides a contract for service, whether it be for a fixed term or otherwise, would not be able to bring an unfair dismissal claim. However, if it can be established that an employment relationship exists, despite the business claiming they are an independent contractor, the individual may be able to bring a claim.

Note: An independent contractor should not be confused with an employee who is on a fixed term employment contract. These workers are employees and are therefore entitled to all the standard employment entitlements for the period of time specified in the fixed term contract.

Here’s how these factors have recently played out in some high profile Australian cases:

Uber – In June this year, the Fair Work Ombudsman finalised its investigation into Uber and found its drivers to be independent contractors, not employees.

The regulator looked at wide range of evidence, including drivers’ contracts, log-on and log-off records, payment records and interviews with Uber drivers. Ultimately, the courts determined that for their drivers to be considered employees, there needed to be, at a minimum, an obligation for an employee to perform work when it is demanded by the employer. “Uber Australia does not require drivers to perform work at particular times and this was a key factor in our assessment that the commercial arrangement between the company and the drivers does not amount to an employment relationship.”

Foodora – A key factor in the Fair Work Commission’s determination in 2018, was its assessment of Foodora’s “Batch” system which determined when Foodora’s bicycle delivery riders could choose their shifts. The system essentially classed riders from top performers down to the bottom performers. Top performing riders were rewarded by giving them first pick of shifts. The FWC deemed this as evidence of Foodora exercising a high degree of control over its workers, such that they were employees, not contractors.

Additionally, the FWC also found that Foodora had unfairly dismissed one of its former riders, after he spoke out publicly about the company’s worsening pay and conditions.

Deliveroo – A Deliveroo rider has launched a sham contracting test case, claiming the company should have paid him almost twice as much as a casual employee rather than the per delivery fee he received as an independent contractor. It’s likely that the outcome of this case will depend on how much control Deliveroo is deemed to have over its riders.

What does it all mean?

While still important and necessary, a carefully drafted independent contractor agreement alone will not be enough to protect businesses. The specific relationship between the business and the individual will be carefully analysed when determining the worker’s employment status.

If you currently engage or are considering engaging independent contractors and have any questions about these arrangements, feel free to give us a call.

If you need any help with developing, maintaining or enforcing social media policies in your business, feel free to give us a call.

Nick Hedges is the founder of Resolve HR, a Sydney-based HR consultancy specialising in providing workplace advice to managers and business owners.